Serious earthquakes can strike anywhere without warning. When they do, the aftermath may be horrific. Catastrophic injuries from earthquakes may occur as a result of flying debris, collapsing walls, or falling objects. Earthquake victims fortunate enough to escape injury may still endure the trauma of confronting destruction of their homes and personal belongings.

Because mild earthquakes are common in California, most residents are aware of the safety measures to follow when the ground starts shaking. However, up to 90 percent of homeowners may face financial devastation after a major quake as a result of a lack of insurance coverage or the reluctance of their insurance company to pay their claim.

The risk of a catastrophic earthquake varies widely across the United States. The closer you live to a fault, the higher your risk of experiencing an earthquake. A fault is a fracture between two plates in the earth’s crust; these plates are constantly in slow motion. The San Andreas Fault in California is the boundary between the Pacific Plate and the North American Plate, which move past each other at approximately 1.5 inches per year.

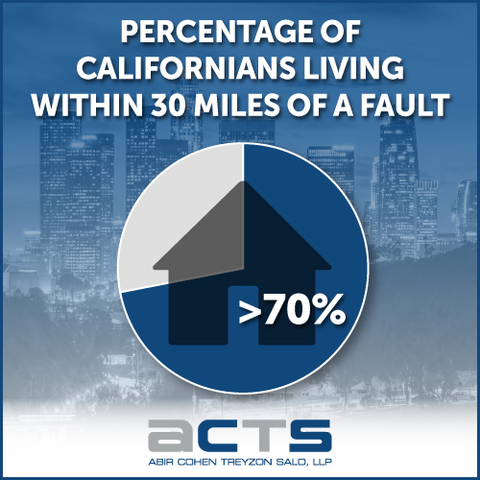

The three largest earthquakes in North America occurred in Missouri during a three-month period in 1811 and 1812. The highest number of large earthquakes per year occur in Alaska; however, most of the affected areas are uninhabited. California has the greatest frequency of damaging earthquakes because much of the population lives near a major fault.

Many Californians live near major faults capable of producing the most intense shaking, which can shift buildings off their foundations, throw off frame structures, and cause partial or total building collapse. Other specific types of property damage caused by earthquakes include the following:

Small earthquakes happen about every other day in California. Although major earthquakes occur less frequently, the risk of disaster is always present.

If you have a mortgage on your house, insurance law may require you to have homeowners insurance. However, most standard policies do not cover earthquakes or landslides. If your car is damaged in an earthquake, your car insurance may cover it, but only if you paid for comprehensive insurance.

When an earthquake destroys your house or compromises the integrity of its structure, the financial costs may include the cost of temporary living quarters and storage, as well as repairs to your home. It may be unsafe to live in your home for some time. If you live in an earthquake-prone area, you should consider purchasing a separate earthquake insurance policy, or getting a quote on an earthquake endorsement, which is an extension of your homeowners’ insurance.

Earthquake insurance can compensate you if an earthquake damages your home or your personal property. However, it is expensive, which is why nearly 90 percent of California homeowners do not have earthquake insurance. If your homeowners policy does not cover earthquake damage and you live in a high-risk area, consider purchasing earthquake insurance. Much of California is considered high risk. Earthquake insurance may be worth the cost if you do not have the money to pay for the following:

The cost of earthquake insurance will vary according to the location and characteristics of your home. The cost will increase if any of the following is true:

Earthquake insurance will also be more expensive if your home is older and has not been retrofitted to withstand an earthquake.

Earthquake coverage typically includes three main parts:

Each section may have separate deductibles and limits. Coverage to replace personal belongings typically includes furniture and electronics, but it may not cover crystal or china. ALE may include paying for a hotel or apartment while your home is being repaired, as well as furniture rental, laundry, moving, and storage. As noted, earthquake insurance is expensive; however, there are some damages that are excluded, including the following:

The financial compensation provided by your insurance policy after an earthquake is subject to deductibles and limits. Deductibles tend to be high. According to the National Association of Insurance Commissioners (NAIC), deductibles for earthquake insurance may range from 10 to 20 percent of the coverage limit. This may be different than a standard homeowners policy wherein the deductible is often stated in terms of a specific dollar amount rather than a percentage. There may also be separate deductibles for personal property.

Given the complexity of earthquake insurance and the nuances of coverage, it is wise to seek legal counsel from a qualified property damage lawyer in advance to make sure you understand the costs and benefits of such a policy.

You may be able to reduce the cost of earthquake coverage by retrofitting your home. Earthquake retrofitting is the process of making a building less likely to sustain damage during an earthquake. Most homes built in the past 25 years have earthquake-resistant features. Older homes can be retrofitted to make them safer. The cost will vary; factors that increase the cost of retrofitting include:

Even if you choose not to purchase earthquake insurance, the process of retrofitting your home may help you avoid property damage during an earthquake. Several processes involved in retrofitting include:

Although some retrofitting projects call for bracing brick chimneys, evidence suggests that bracing does not always work. Several deaths have occurred during earthquakes as a result of brick chimneys collapsing and falling on children. The best option may be to replace the brick with a lighter substance.

Earthquake damage is not covered by most standard commercial property insurance policies. Commercial earthquake insurance will cover repairs to your building and loss of business equipment after a quake. It may also provide coverage for business interruption, including lost income, employee wages, and lease payments. However, business interruption coverage lasts only for a specified time period, and it is important for building repairs to be complete before coverage runs out. You may need to arrange for inspection of your business property to qualify for commercial earthquake insurance.

After an earthquake, you should contact your insurance company even if you do not have earthquake insurance. Notify your insurance agent in writing that you have sustained damage. Do not hesitate to get a second opinion if your adjuster says that your damage is less than your deductible. Serious earthquakes are relatively rare, and your adjuster may not know how to check for damage. You may want to hire a licensed structural engineer. Other steps include the following:

Finally, do not provide a final Proof of Loss form to your insurer prior to contacting your attorney. It is imperative that you clearly understand your rights and the full value of your claim first. Do not let your adjuster rush you into a quick settlement.

Make sure you obtain the full amount estimated by your own contractor, not the insurance company. Earthquake repairs are costly; do not agree to cut corners, such as simply getting epoxy injections to fix a cracked foundation, as this may not satisfy local building codes.

FEMA’s role in earthquake assistance is primarily limited to education and risk mitigation. FEMA’s National Earthquake Hazards Reduction Program (NEHRP) provides grant money to states to develop seismic mitigation plans, conduct safety inspections of critical structures, update building codes, and promote awareness of commercially available earthquake insurance. Although FEMA may provide disaster relief after government officials declare a natural disaster, this assistance is in the form of loans that must be repaid, and the amount and timing of payment are always uncertain.

It is notoriously difficult to file an earthquake damage claim. Insurers may challenge claims for many reasons, including paperwork mistakes, time limits, and pre-existing damage. The experienced Los Angeles property damage lawyers at ACTS LAW, LLP understand the complexities of filling earthquake damage claims and are prepared to advocate for maximum compensation on your behalf. Call us today at 833-228-7529 for a free consultation or contact us online. We serve clients throughout Beverly Hills, Calabasas, Malibu, Santa Monica, Long Beach, Hidden Hills, Pasadena, San Marino, Brentwood, Encino, Newport Beach, Foresthill, and throughout Orange County and Los Angeles County from our offices in San Diego and Los Angeles.

Client Reviews

“From beginning to end ACTS listened, suggested, discussed and acted on my behalf! Thanks ACTS team!!!”

View More Reviews on Google Maps and Yelp